Is your Enterprise Experiencing financial Hardship? The Employee Retention Credit (ERC) {Program|Initiative|Policy) could be a Game-Changing tool to Enhance your bottom line. This refundable tax credit allows eligible businesses to Receive substantial Reductions for Past payroll expenses, even if you Utilized other government assistance Funds. Uncover how ERC funding can help you Offset your tax liability and Strengthen your financial Position.

Unlocking Business Growth: The Power of ERTC Loans

In today's dynamic and competitive business landscape, companies are constantly seeking innovative ways to maximize their growth. The Employee Retention Tax Credit (ERTC) has emerged as a valuable tool for businesses to obtain the financial resources needed to thrive. ERTC loans provide a unique opportunity for companies of all dimensions to utilize tax credits, fueling expansion and cultivating a sustainable future. By transforming existing tax liabilities into immediate capital, ERTC loans empower businesses to allocate in crucial areas such as innovation, employee acquisition, and operational improvements.

- Additionally, ERTC loans offer businesses a flexible financing solution that can be customized to meet specific needs. Consequently, companies can {strategically{ allocate resources, promoting long-term prosperity.

Effortless ERC Funding Solutions for Every Business

Securing funding is often a daunting task for businesses. But with the right resources and a little knowledge, you can unlock the potential of financial assistance. Our experts are dedicated to helping businesses like yours navigate the complex world of ERC funding and access the resources they need to thrive. We offer a diverse selection of solutions tailored to your unique needs, ensuring a smooth and easy process from start to finish.

- Exploit the power of ERC funding to fuel your business growth.

- Access personalized guidance from industry experts.

- Simplify the application process with our support.

Should an ERC Loan Right for Your Company?

Considering an Employee Retention Credit (ERC) loan can be a complex decision for any company. Before taking the plunge, it's crucial to carefully evaluate your situation and understand the pros and cons. An ERC loan may be helpful if your company has undergone significant revenue reduction due to the pandemic. However, it's essential to evaluate factors such as your current financial health, future outlook, and compliance with ERC regulations. In conclusion, consulting with a tax professional can provide valuable guidance in determining if an ERC loan is the right solution for your company.

Choosing ERC Loan vs. ERTC Funding: Which is Best for You?

hereDetermining the optimal funding solution for your enterprise can be a complex process. Two popular options often considered are the Employee Retention Credit (ERC) and ERC Loans. Both offer valuable assistance to businesses thriving in today's economic climate, but they work in distinct ways.

The ERTC is a tax credit that reduces your payroll tax liability. It's based on the wages you distributed to employees during specific stages. ERC Loans, on the other hand, are available funds that require settlement over time.

- For the purpose of make an informed decision, consider your current financial situation and future needs. Factors like your revenue, staff count, and field can profoundly influence the optimal funding route.

- Speaking with a qualified financial advisor is always advised to thoroughly understand the nuances of each program and establish the most favorable solution for your specific circumstances.

Secure the Financial Future of Your Business with ERC Funding

Are you seeking ways to improve your business's financial stability? The Employee Retention Credit (ERC) program can provide a valuable opportunity to help navigate current economic challenges. This refundable tax credit allows eligible businesses to claim significant support based on their costs. By harnessing ERC funding, you can allocate in crucial areas such as expansion, workforce retention, or simply strengthen your financial base.

- Optimize your tax benefits with expert ERC guidance.

- Identify if your business qualifies for this valuable credit.

- Take proactive steps to protect your financial future.

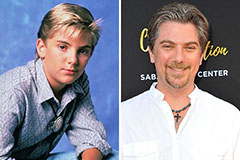

Brian Bonsall Then & Now!

Brian Bonsall Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!